Average annual fee is $300

Sort by

| Credit card | Bonus points Earn rate Annual fee Estimated Qantas Points |

|---|

$200 BACK TO YOUR NEW CARD*

Uncapped Qantas Points earning potential

2 Qantas Club Lounge Invitations per year

per $1 spent

based on

$450 Qantas Travel Credit^

Complimentary Travel Insurance

Up to 4 Additional Cardholders for no extra fee

per $1 spent

based on

2 Qantas Club Lounge Invitations per year

Complimentary Travel Insurance

per $1 spent

based on

Enjoy up to five complimentary insurances

NAB Concierge Service

per $1 spent

based on

2 Qantas Lounge Invitations per year

Up to 20% discounted fares for domestic Qantas flights

per $1 spent

based on

Uncapped Qantas Points earning potential

Two complimentary lounge visits

per $1 spent

based on

Complimentary International Travel Insurance

per $1 spent

based on

2 Qantas Club Lounge Invitations per year

Complimentary Travel Insurance

per $1 spent

based on

Complimentary Travel Insurance

per $1 spent

based on

$100 BACK TO YOUR NEW CARD*

Uncapped Qantas Points earning potential

Complimentary Travel Insurance

per $1 spent

based on

Up to 55 days interest free period

Complimentary Travel Insurance

per $1 spent

based on

0% p.a. Balance Transfer for 12 months

Additional cardholders for no extra fee

per $1 spent

based on

No international transaction fees

Complimentary International Travel Insurance

per $1 spent

based on

Additional cardholder for no extra fee

Platinum Visa Concierge

per $1 spent

based on

Up to 4 Additional Cardholders for no extra fee

Uncapped Qantas Points earning potential

per $1 spent

based on

Uncapped Qantas Points earning potential

Access to International Travel Insurance

per $1 spent

based on

Uncapped Qantas Points earning potential

Complimentary Travel Insurance

per $1 spent

based on

20% bonus Status Credits on Qantas flights

10% discounted base fare for Qantas flights

per $1 spent

based on

2 Qantas Club Lounge Invitations per year

Complimentary Travel Insurance

per $1 spent

based on

2 Qantas Club Lounge Invitations per year

Complimentary Travel Insurance

per $1 spent

based on

2 Qantas Club Lounge Invitations per year

Complimentary Travel Insurance

per $1 spent

based on

Up to 55 days interest free period

Complimentary Travel Insurance

per $1 spent

based on

Up to 55 days interest free period

Complimentary Travel Insurance

per $1 spent

based on

Complimentary insurances

No fee for additional cardholders

per $1 spent

based on

Up to 55 days interest free period

Complimentary International Travel Insurance

per $1 spent

based on

No international transaction fees

Complimentary International Travel Insurance

per $1 spent

based on

Complimentary Travel Insurance

Only for Medical, Dental, Veterinary & Accounting specialists

per $1 spent

based on

Up to 9 additional cardholders for no extra fee

Only for Medical, Dental, Veterinary & Accounting specialists

per $1 spent

based on

Eligible government payments earn 0.66 PTS per $1 spent

Up to 44 days interest free period

per $1 spent

based on

Uncapped Qantas Points earning potential

Up to 55 days interest free on eligible purchases

per $1 spent

based on

Up to 51 days to pay for purchases

2 Domestic Qantas Club Lounge Invitations

per $1 spent

based on

Up to 55 days interest free period

A range of complimentary insurances

per $1 spent

based on

Up to 99 additional cardholders

Qantas Business Rewards membership

per $1 spent

based on

Extra control with Lock, Block, Limit

per $1 spent

based on

Access to International Travel Insurance

Extra control with Lock, Block, Limit

per $1 spent

based on

You may be interested in:

Qantas Money Home Loans limited time offer*

Receive a $1,000 Qantas Hotels & Holidays voucher on all loans of $500,000 or more.^ Submit your application before 30 October 2025 and settle by 30 Apr 2026. Plus, earn 100,000 Qantas Points every year for the life of the loan.*

Drive away with 35,000 bonus Qantas Points

Take out a novated lease with Smart by 17 December 2025 and you could fuel your next adventure^^.

Let your finances take you places

Earn over 200,000 bonus Qantas Points across our range of Financial Services partners. From home loans to banking, to credit cards and investing, they’re finances that can take you places.

How you can compare credit cards

When it comes to choosing a credit card, there’s a wide range in the Australian market for you to choose from. While this means plenty of choice, it also means that it can be difficult to choose one option. So, when comparing cards, the most important thing to ask yourself is, ‘what are the main things I want from a credit card?’ Given you're on our site, we're guessing that Qantas Points are important to you, but what about a low annual fee? Rewards? Or maybe it’s a low-interest rate? Here’s some information that will help you narrow down the best credit card for points and your needs.

What is a credit card?

A credit card allows you to borrow money from a bank to make purchases. As long as you pay back the money you borrow within the interest-free period (usually between 45 and 55 days), you don’t have to pay any extra. If you don’t pay back the money within that time, interest will accrue. Besides offering greater spending power and financial flexibility, some credit cards also let you earn points on your spend - points you can then use to redeem for rewards, like flights, hotels and other products.

Differences between a credit and debit card

Different payment methods suit different situations, which is why many people have both a credit card and a debit card. The main difference between a credit card and a debit card is that with a debit card, you are spending your own money from your bank account; while a credit card allows you to borrow money and repay it later. Credit cards may also charge interest if you don’t pay your card off within the interest-free period.

Types of credit cards

There are two main types of credit cards - personal use credit cards and credit cards specially for business. The key difference is that business credit cards - as the name suggests - are designed for business use, while personal credit cards can be used by anyone. Within the personal use category, there are numerous types of credit cards that focus on different features and benefits, for example, low rate credit cards.

Which are the major credit card providers?

If you’ve been wondering which credit card provider to choose, for example, Visa, Mastercard or American Express; it pays to do a little comparative research to see which is the right one for you. All of the major banks including Westpac, ANZ, NAB CommBank and more, offer Qantas Points earning credit cards. Compare each bank’s card rates and benefits to determine which is the best card to suit your needs.

Other benefits to consider

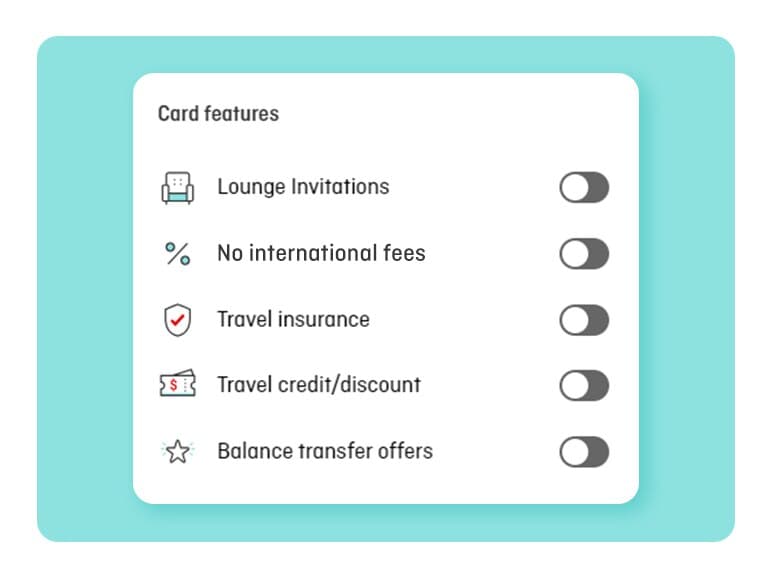

When comparing the best credit card for you, other than the interest rate, other benefits you may want to consider include whether or not your card offers Lounge Invitations, what the currency conversion rate is and whether it offers travel insurance or travel credits/discounts.

Apple Pay, Google Pay and Samsung Pay

The three biggest options for mobile payment systems are Apple Pay, Google Pay and Samsung Pay. They all turn your smartphone (and some smartwatches) into a mobile wallet so you can pay for purchases without a physical credit card or cash. Google Pay is made for Android phones, Apple Pay works with iPhones and iPads, and Samsung Pay is geared for Samsung devices. Just go with the system you already use - that means Apple Pay if you have an iPhone and Google Pay or Samsung Pay if you have an Android device.

Did you know?

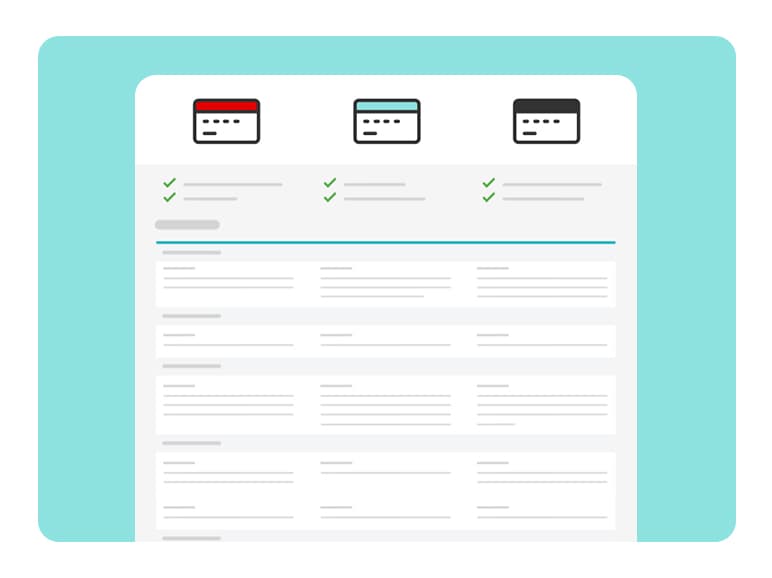

You can sort, filter and compare up to 3 credit cards at a time so that you can find the one that’s right for you

1. Click the ‘Sort by’ button to sort the cards in the order of your choosing

2. Click the ‘Filter’ button to add specific card features or benefits you want

3. Tick the ‘Compare’ box on up to 3 credit cards of your choice to view the relevant card information in the table

Not a member? Join Qantas Frequent Flyer for free.

Popular credit card features

What you need to know

You must be a member of the Qantas Frequent Flyer program to earn and use Qantas Points. A joining fee may apply. Membership and points are subject to the Qantas Frequent Flyer program Terms and Conditions. Qantas Points are earned on eligible purchases through the relevant card partner and card partner reward program.

Products referred to are not Qantas products and not offered or issued by Qantas but by the relevant Australian Financial Services Licence (AFSL) or Australian Credit Licence (ACL) holders. The information about the relevant product has been provided by the relevant licensees and not Qantas. Qantas does not hold an AFSL or ACL and is not a licensee or authorised representative in relation to the activities being engaged in by the relevant licensee (except for Qantas-branded products).

The information provided is factual and of a general nature only and does not consider your personal objectives, financial situation or particular needs.

Qantas is not recommending the products described. We recommend that you obtain independent advice before you apply for any product. Qantas does not accept any liability for any loss arising from the use of, or reliance, on the information provided.